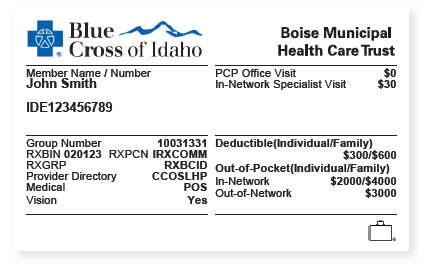

NEW MEMBER ID CARDS ARE COMING, JUNE 2024!

This impacts both Blue Cross and St. Luke's Health Partners Participants.

For more information, visit our Frequently Asked Questions page.

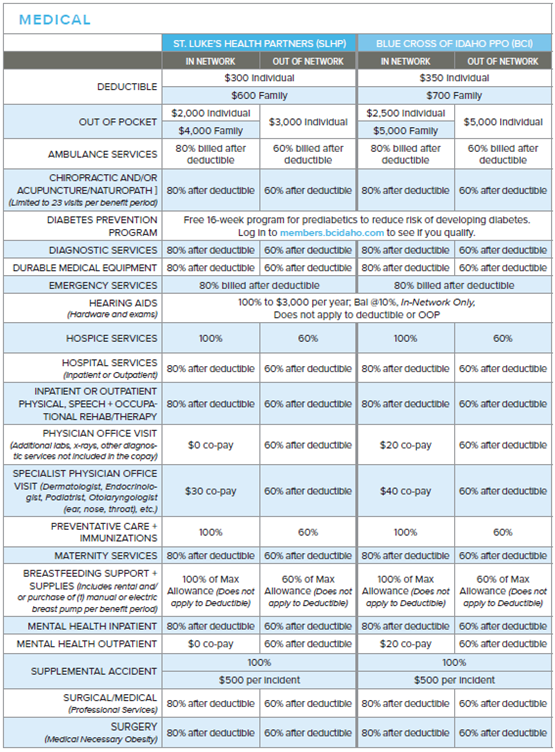

Comprehensive and preventive healthcare coverage is important in protecting you and your family from the financial risks of unexpected illness and injury. A little prevention can go a long way— especially in healthcare. Routine exams and regular preventive care provide an inexpensive review of your health.

Plan Information

The City of Boise has two self-funded plans available for non-temporary employees who are regularly scheduled to work 20 or more hours per week.

The City of Boise offers three medical plans for you to choose from, two Preferred Provider Organization (PPO) networks and one Coordinated Care Organization (CCO). With the PPO, you may choose any provider that accepts Blue Cross. On the other hand, the CCO is specific to St. Luke’s Health Partners (SLHP) which consists of providers at St. Luke’s, Primary Health, Saltzer Group and many other independent doctors.

Dependents are defined as your spouse and/or dependent children up to the age of 26. Coverage begins the first of the following month from the date of hire.

You may select the plan and level of coverage which best meets the needs of you and your family members.

Diabetic Prevention Program

Renewed! Diabetic Prevention Program - 16 week program to reduce the likelihood of developing diabetes. Click here to see if you qualify!

Other Important Documents

Creditable Coverage Notice

Member Certificates and Plan Highlights

Special Enrollment Rights

Women's Health and Cancer Rights Act (WHCRA)

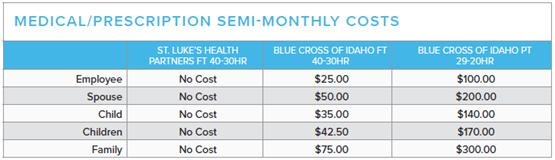

Contributions

The cost per paycheck for medical and vision varies based on your personal choices. Employees receive benefit credits based on scheduled hours per week and the level of coverage chosen for medical and vision. Additional credits may be earned through the Boise Healthy Life program which could offset the contribution amounts by as much as $500 per year.

Opt-Out Incentive

Employees that do not wish to participate in a medical plan can opt-out and can receive a monetary incentive paid as taxable cash unless used towards another pre-tax plan option. To receive the incentive, employees will be required to provide Human Resources with proof of other coverage such as a spouse's group health plan, military retiree TriCare coverage, or an individual health insurance policy. Employees are unable to have double coverage through a spouse and/or dependent also working for the city. Therefore, the opt-out incentive will be provided to the employee declining coverage.

Download the Verification of Insurance form (PDF)